ELEMENT 6th Anniversary in 6 Highlights

As the leader in the seamless delivery of insurance for our partners in Europe, we're proud to provide the fastest, highly flexible, always reliable, and most efficient services for our partners. We've had an incredible year, and we're excited to share with you our 6 highlights of the past year. Thank you for being part of our journey, and cheers to many more years of success together!

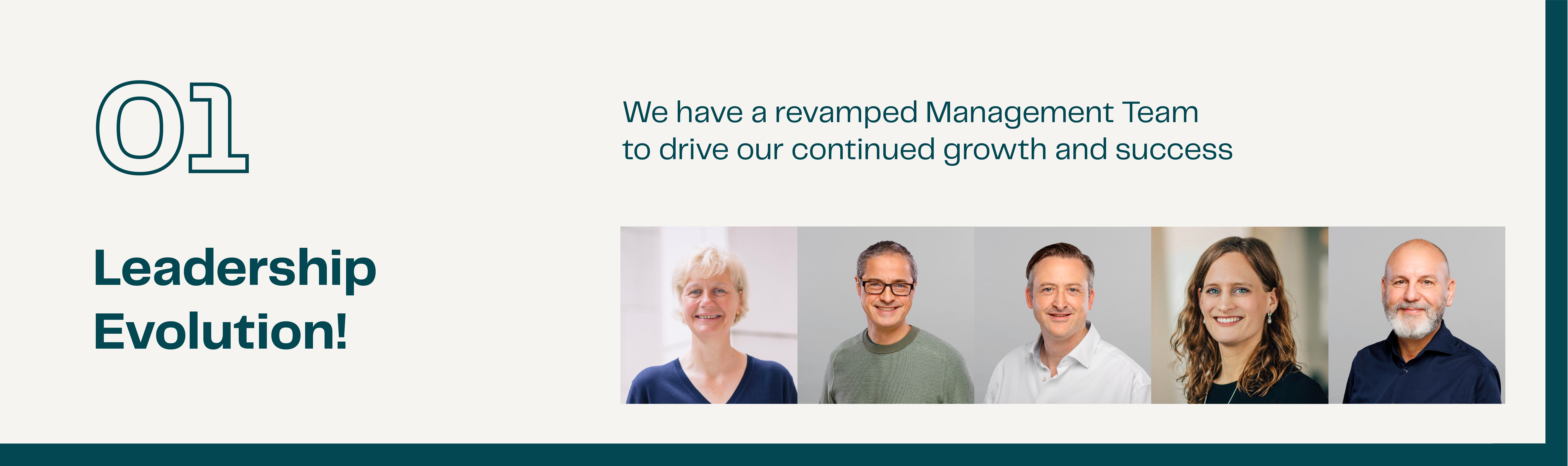

01 Leadership Evolution!

In our current phase of scaling up, we are making personal changes to ensure that the right team is driving our company towards growth and scalability. In Autumn 2022, we welcomed internationally renowned insurance expert Astrid Stange as the CEO to lead our management team. Following that, Fabian Fischer and Stefan Heisig joined to head ELEMENT's national sales department as Head of National Sales and Head of Intermediary Sales respectively.

In November 2022, we appointed Laura Kauther as Commercial Director to drive the systematic expansion of ELEMENT's focus markets. In the People department, J�rg Schmidt joined us as SVP People and Chief Representative on 1 January 2023. As an experienced HR strategist, he is playing a crucial role in determining the future direction of the company, together with CEO Astrid Stange.

Lastly, in February 2023, Philipp Hartz and Michael Bongartz were appointed to join the Executive Board, along with Astrid Stange (Chief Executive Officer) and Schuh (Chief Financial and Insurance Officer). This appointment is an important step for ELEMENT's leadership in terms of expertise and responsibilities, while being well-positioned to scale the company in the coming years and to bring ELEMENT to the next level of success in the long term.

In Astrid Stange's own words:

"I am delighted about this reinforcement of our Executive Leadership Team, and I highly appreciate the vast experience of my two colleagues. I am fully convinced that this new set-up will be decisive for the scalability and future success of ELEMENT."

02 Scaling Up!

In July 2022, we announced the closing of our Series B and we also achieved our best YTD result ever. The investment round was led by the Versorgungswerk Zahn�rztekammer Berlin (VZB), and additional investments in the success of the digital insurance company were made by Alma Mundi, Witan Group and Ilavska Vuillermoz Capital.

The current investment round underlined our continuous growth. In 2021, sales rose to 10,4 million euros - an increase of over 50 per cent compared to the previous year. The mark of 200,000 customers was exceeded as well and more than 50 partners distribute ELEMENT products, including two DAX 40 companies. With our partners and more than 140 employees, ELEMENT is now acting as a risk carrier in several EU countries and continues to expand its position as a leading pan-European provider of fast, efficient, and reliable end-to-end insurance solutions.

This was another great benchmark to achieve our vision of being the leader in the seamless delivery of insurance products to our partners in Europe.

03 Exciting New Partnerships!

Our partners are at the core of ELEMENT. To achieve our vision of seamless delivery of insurance, our mission is to strive towards accomplishing the fastest, highly flexible, always reliable, efficient insurance solutions

As an Insurtech, we achieve this through

- our deep understanding of lean internal and external insurance processes

- and our proprietary technology, which enables the utmost automation as well as making our products easily embeddable and highly accessible to our business partners

In cooperation with AutoProtect we created an entirely new, embedded dealer-centric Test drive deductible insurance product, which is fully digital and groups insurance for the dealer without any intervention for the individual test drive. The results are clear: Through AutoProtect�s innovative solution, car dealers will continuously expand their customer service and customer loyalty.

We partnered with the renowned classic car insurance specialist OCC Assekuradeur GmbH. OCC invented insurance for classic cars when many of the classic cars insured today were new cars. From October 2022, classic car owners can also insure their vehicle with a repair cost insurance offered in cooperation with ELEMENT. In addition, OCC now not only insures your classic car, but also dogs traveling with you as part of the partnership with ELEMENT. The insurance protects dogs in the event of a car accident and can be a good supplement to the regular car policy.

We expanded also our partnership with Schutzgarant, with whom we have once again been recognized with two awards for our joint products:

- Stiftungwarentest has recognized our ELEMENT 'Gold plus' Bike Insurance

- Chip.de has named our "Handy Schutzbrief Premium" mobile phone insurance �best in class�

We have also recently launched two new bicycle and e-bike insurance products with Schutzgarant- "Bicycle Insurance Gold+" and "E-Bike Insurance Gold+". With 5 million bicycles and e-bikes sold annually, and 20% of buyers opting for separate insurance for the more expensive e-bikes, Schutzgarant and ELEMENT are meeting the growing demand for bicycle and e-bike insurance with comprehensive protection at a competitive price.

In the pet insurance space, our partnership with Panda underlines what sustainable insurance products will look like in the future � part of the revenues will flow into social or ecological projects. This meets some of the UN's 17 sustainability goals, which organisations must implement in order to guarantee sustainable business. Panda is a pioneer in this regard in Germany.

The involvement of a telemedicine provider illustrates how digital ecosystems can be developed through vertical offerings. In this way, innovative companies gain an efficient advantage over providers who only rely on a digital offer without creating any added value for their customers.

The combination of pet insurance with a sustainable donation concept is unique in Germany; hence, every sold insurance policy from Panda will make a difference for a better future.

04 Welcome to Our New Home!

Our new office is a welcoming space, where we come together to work as a team. Located in the heart of Berlin, surrounded by high-growth start-ups and scale-ups in the Backfabrick ecosystem, is it the perfect place for the current phase of ELEMENT. Our new space provides a great environment for growth, and it creates a great and sustainable work place thanks to its energy-efficient spaces.

05 Fresh Look!

A rebranding is almost always a productive reaction to internal and external change processes. After ELEMENT had successfully established itself in the insurance market over the past years, it was time for us to question ourselves again and show our change via our brand narrative, in order to be ideally positioned for the next few years and the set goals. We re-told the company's story: from passion and conviction, constant growth to far-sighted goals.

Our new look and feel captures the dynamic of what ELEMENT does: breaking down the digital world into its smallest element, the pixel, and building a new concept from it. This has led to a new color palette, grid, and endless visual assets and feature combinations. The new colors emphasize our innovative power with clarity and stringency. The new design combinations are in sync with the product and feature combinations in ELEMENT's portfolio - the most innovative solutions in the industry that ELEMENT offers for the entire value chain of insurance needs. Our vision and mission have come alive!

06 Growing Portfolio!

As part of a strategic partnership, ELEMENT started supporting mailo Versicherung AG in August 2022, with the aim of further expanding its product offering for brokers and to increase underwriting opportunities in commercial insurance. Founded in 2017, mailo offers custom-fit solutions for freelancers, small business owners and the self-employed in over 700 types of business with optimal coverage of insurance risks. The digital commercial insurance provider can thus focus more on the quick and easy provision of custom-fit solutions for broker partners and other distribution channels. As a strategic risk carrier, ELEMENT ensures that mailo's products and individual broker concepts can be offered quickly and cost-effectively. In addition, ELEMENT enables mailo to significantly expand its coverage options for policies.

Today, ELEMENT covers more than 25 lines of business, and thus the essential areas of a property, liability and accident insurance provider.