Embedded Insurance: Tackling the Opportunity

The popularity of the topic alone shows that embedded insurance is not easily tangible: although it has been the centre of many debates at major insurance industry conferences for a good ten years now, papers attempting to define it are still coming out in 2022.

The most recent one is from Bitkom with the title "Embedded Insurance – Classification, Use Cases, Outlook". A glance at the structure already reveals what a "broad field" we are dealing with in this topic:

It goes from the "Definition of embedded insurance - what is it and what it is not" to the "Classification - old wine in new bottles" to "Development and added value of embedded insurance" to the different perspectives of policyholders, sales partners, and insurers. To end with questions on the "Requirements for product, sales & IT in an embedded insurance scenario".

An approach to a definition

As a starting point for this blog and webinar, let's work with the definition from the paper.

Therefore, we understand embedded insurance as

- seamless integration of insurance products into third-party value creation processes with the purpose of optimising the customer journey in line with regulatory requirements (Demands- and Needs-compliant),

- direct connection of insurance products to a core product or service (bundling),

- extension of the familiar annex distribution by means of data and technology, again enabled by open insurance initiatives.

We will share the link to the paper at the end of this blog.

So far so good. But why are there so many players in the race for the best embedded solutions?

The growth markets

There are various figures on the potential market size in embedded insurance. One assumption – and we choose this one because the author is a proven expert in this field – can already be found in the title of a blog post by Simon Torres.

"Embedded insurance: a $3 trillion market opportunity that could also help close the protection gap."

You can read the article here. Of these $3 trillion, he guesses that $700 billion are in property and casualty insurance alone. Handelsblatt picks up on this exact sum here. InsTech London speaks of 722 billion dollars in gross premiums worldwide by 2030. Assumptions of a similar amount can also be found in other articles. So, there is a lot of "music" in this area.

But why the period up to 2030?

A home run for Gen Y

But this music sounds more like world-weariness and a TikTok jingle than guitar riffs and pathos. In other words, embedded insurance is a home run with younger generations, who are used to seamless buying through Instagram, TikTok and online shops.

The trick: as they get older, their income and need for protection also increase.

The moral of the story: the signs for embedded insurance are set for success in both the zeitgeist dimension and the market maturity dimension.

But how does a company tackle such a complex topic?

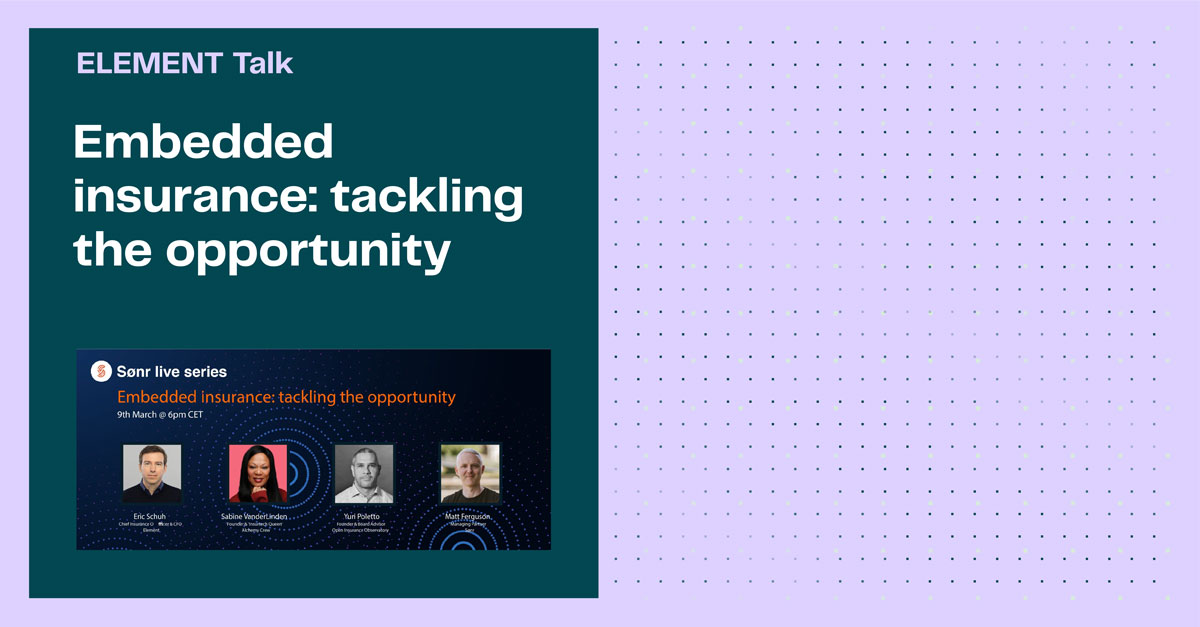

The webinar: Embedded Insurance – tackling the opportunity

We asked ourselves the same question and the line-up of our panel was accordingly an acknowledgement to both this question and the complexity of the topic.

Sabine Vanderlinden: "The InsurTech Queen" and author of the Insurtech Book.

Yuri Poletto: Founder of the Open and Embedded Insurance Observatory

Eric Schuh: CFO and CIO at ELEMENT.

We divided the webinar into three parts:

- A general observation of the market: what has changed that embedded insurance has gained so much momentum in the last two years?

- What are the practical challenges of embedded insurance? With a view to the systems, the IT legacy, but also to the "alignment of interests". So, how can the topic be approached so it offers added value/profit for both the distributor and the end customer?

- Which mistakes have been made?

In short: What is embedded insurance and how do you benefit from it? Find out in this video.

Embedded Insurance: Starter Kit

This may all sound attractive in theory, but what are precise and quick actions you can take to get started with embedded insurance? From the panel discussion, we extracted three clusters that form the structure for a rudimentary guide.

1. Insurance infrastructure

The basis for the distribution of insurance solutions is an infrastructure that guarantees a secure data flow from the front end, i.e., the place of a conclusion, to the administration. This digital presence should provide maximum benefit to all stakeholders: for the end consumer, it should be secure, intuitive, and highly functional. For distributors, the focus should be on high operational efficiency, reliability, and a trouble-free data flow.

2. Insurance products

There is no getting around the fact that insurance solutions must meet new criteria. One is the digital DNA – documents are being sent by email, not just by letter. Prices can be adjusted in real-time. Another point should be clarifying the "alignment of interest" early on. Questions to ask can be: What does their target group need? What do you need? No consumer sells or buys insurance because they enjoy it. There are good reasons for both and the clearer these are reflected in the design of the offer, the more successful the venture will be. Modular and highly customisable solutions offer the greatest potential here.

3. A strong partner

Insurance is a sensitive product because it is especially needed in times of need. If you don't respond appropriately in these moments or there are problems in the processes, it falls back on your reputation and brand. Due to the growing InsurTech industry, there are now some partners who can deliver embedded solutions. A critical review along the dimensions is recommended here.

Keen for more? Find the Bitkom paper on embedded insurance here.

Why build when you can partner?

If you add it all together, embedded insurance is a megatrend that – with the right design – generates immense added value for partners and customers. If you are looking for a partner to get on board: contact us.

ELEMENT operates on a white-label basis and along the two dimensions of infrastructure and products: White-label modules such as the conclusion route and customer portal enable the distribution of insurance solutions. Both can be easily integrated into your systems using state-of-the-art technology.

We already offer a wide range of insurance products in property and casualty insurance: from traditional products such as home contents and liability policies to innovative solutions such as parametric cloud default insurance. All our products are designed as white label solutions and are customisable to your needs.

Over 30 partners from the insurance industry, the telecommunications sector, and the automotive sector, as well as other industries, already rely on our market-tested insurance solutions.