Sales and delivery of insurance in B2B2C

Sales and delivery are two integral components of insurance products. But what exactly does that mean for B2B2C business in the insurance industry?

In classic direct sales, the usual process works as follows: After a consultation with the agent (e.g. on real estate insurance), the office worker submits an application for the insurance company to issue the policy, which the agent then sends to the customer. A clear process that works quickly and easily in most segments today - whether on paper or digitally (topics such as industry left out).

This applies to every business model, be it directly targeting the end customer (B2C) or to other companies (B2B).

When it comes to B2B2C businesses in the insurance industry, the dynamics become more interesting. B2B2C refers to the sale of insurance products from one insurance company to a second company, which then sells the product to end customers. In this context, end customers have minimal direct contact with the insurance company outside of claims.

This is usually white-label insurance. With white label insurance, an insurance product is developed by one insurance company for another company. The partner company or the insurance intermediary or broker then sells this product under its name (or brand ). These white-label products are not sold under the actual insurer's brand that assumes the risk. Instead, white-label insurance is integrated into the partner company's existing user journey, delivering cost-effective and personalized insurance products to customers exactly when and where they need them.

Embedded insurance is the integration of insurance benefits into products or services that go beyond the actual insurance purpose. For example, embedded lease return insurance protects lessees from the costs of damage during the return transport of a leased vehicle, minimizing risk for the lessee and increasing certainty for the lessor. Another example is integrated accident insurance for car sharing or carpooling, automatically insuring passengers in the event of an accident.

Overall, embedded insurance enables companies to offer their customers additional security and protection, while at the same time minimizing their own risks and expanding their offering.

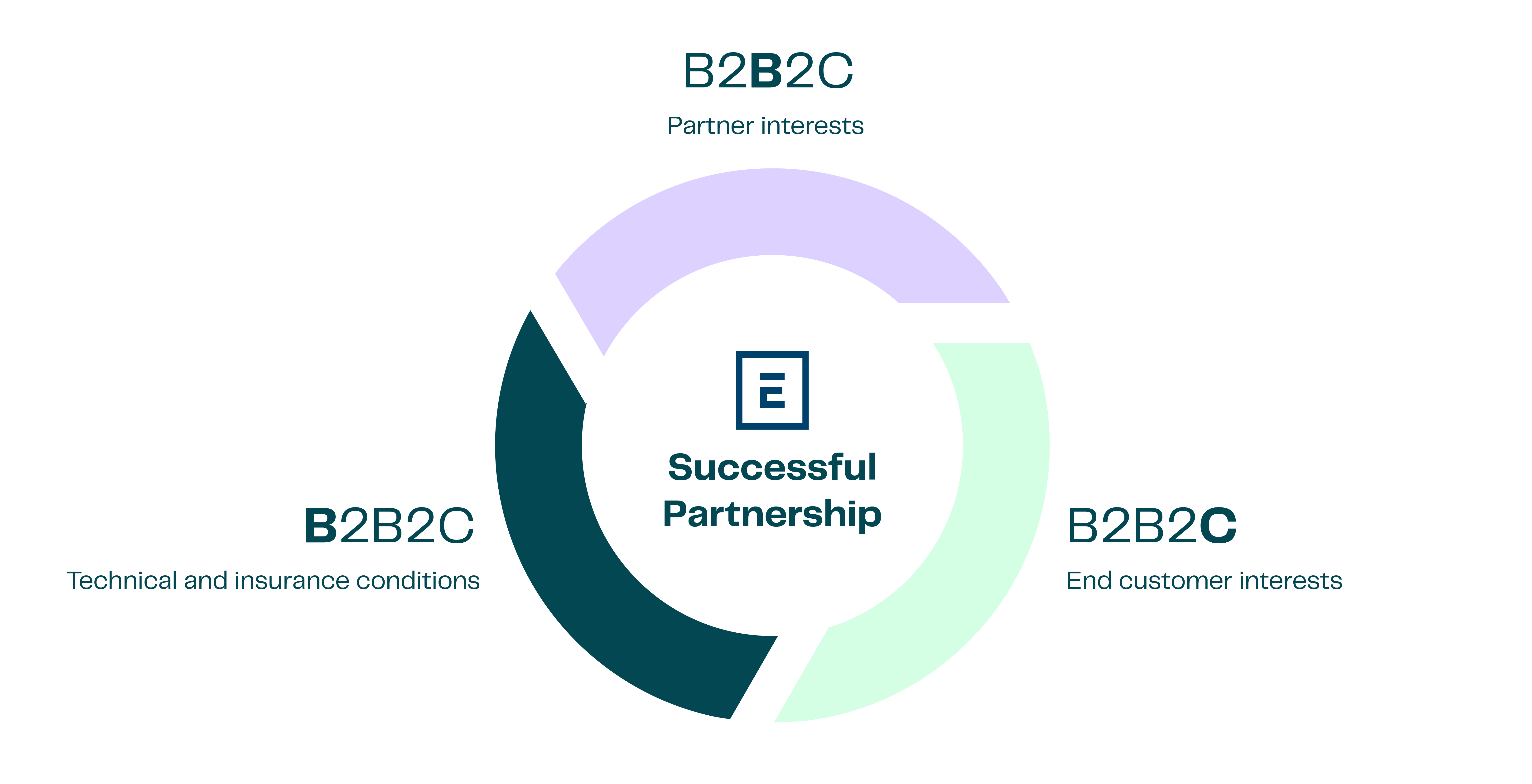

The challenge for insurance companies in B2B2C sales is understanding the context and interests of their sales partners, such as underwriting agents. To ensure a successful partnership, insurance companies must answer several questions:

- What is the interest of the business partner?

- What is the end customer interest ?

- What are the technical and insurance conditions that need to be taken into account?

Balancing all three points, the first task of insurance sales is to validate whether working together would bring benefits to all parties involved.

Then it must be calculated which joint (insurance) solution can be developed with what effort and dependencies. This process begins with sales, which inquires about and validates the general conditions and requirements of the partner. This includes (but is not limited to):

- Regulatory framework

- Technological requirements, skills and resources

- (Actuarial) data basis

- End customer demand and benefit

Accurate documentation of this process step enables efficient project setup. The added value and necessary steps behind the mediation in the B2B2C context are closely interconnected, and even small changes can have significant consequences.

From an e-commerce perspective, whether insurance is sold as optional or mandatory is simple - you just tick it or not. In the insurance industry, however, this decision has implications for the legal model, claims needs, the collections process, and more. It is therefore crucial that insurance companies carefully consider the implications of their decisions and ensure they meet the needs of their customers while also complying with legal and regulatory requirements.

Therefore, the project planning must be carried out precisely and handed over to experts who specialize in the management of value creation (Partner Onboarding Managers � POM - or similar).

For efficient project implementation, it is then important to distinguish between two working levels:

- Sales negotiates and controls the commercial framework.

- The project management negotiates and controls on an operational level (and the associated effort).

The two strands of work often overlap, which requires precise coordination, in which the different interests must be taken into account.

For example, the sales department is focused on sales figures, while the project team focuses on the targeted implementation of the previously defined plan. A balance between sales figures and maximum customer orientation, which is opposed to operational implementation, can only be achieved in such a situation through communication and strategic orientation.

The prerequisites for a successful project are only met if there is close coordination between sales and the project team - it can be delivered.

Finally, "delivery" and end-customer satisfaction are the common core in B2B2C sales. Only coordinated product development, process development and technical implementation can ensure successful delivery.

The successful delivery of insurance products is a crucial aspect in B2B2C sales as it directly impacts end customer satisfaction and the overall success of the business. Strategic positioning helps insurance companies highlight their strengths and differentiate themselves from the competition. A customer-centric approach ensures that customers' needs are always the focus and that the solutions provided meet those needs. This requires seamless collaboration between the sales and project teams with a shared focus on delivering quality solutions. By prioritizing effective communication, strategic positioning, and a customer-centric approach, insurance companies can not only meet, but exceed, the needs of their customers and position themselves in a highly competitive marketplace.