Reliability in Insurance. What are the Key Elements to Achieve it?

Insurance is an essential component of modern life. From liability to pet health and to cyber insurance, it provides individuals and organizations with a safety net against unforeseen events. However, insurance is only effective if it is reliable. This means that insurance policies should be well-designed, fairly priced, and able to deliver what they promise when the time comes. At the same time, technical reliability also plays a key role in the ability to deliver promises. At ELEMENT, we always keep in mind this dual concept of business and technical reliability, its importance for our B2B2X approach, and how it can be achieved together with our business partners.

What is Reliability in Insurance?

In general, reliability in insurance refers to the ability of the insurance company or the policy to meet the needs of the policyholder when necessary. It requires being dependable, consistent, and trustworthy; and it is crucial for insurance providers to be reliable because it gives the policyholders peace of mind that they will be protected when something unpleasant happens.

There are 3 essential pillars to it: Trust, Financial Security, and Compliance. To achieve these pillars, insurance companies need to have reliable IT systems that perform fast and provide high protection and security.

Especially for B2B2X set-ups, reliability is essential for all the actors involved. ELEMENT as the insurance carrier works together with a partner or intermediary to offer insurance services to end customers. In such cases, both the intermediary and the end customers rely on the insurance carrier to provide timely and accurate services. This is why ELEMENT places great emphasis on developing and maintaining robust IT systems and infrastructure. These systems are designed to ensure that all policy-related information is secure and accessible only to authorized personnel and that claims are processed efficiently and accurately. By providing reliable insurance services, we build trust with our partners and policyholders and establish ourselves as a leader in the delivery of insurance services.

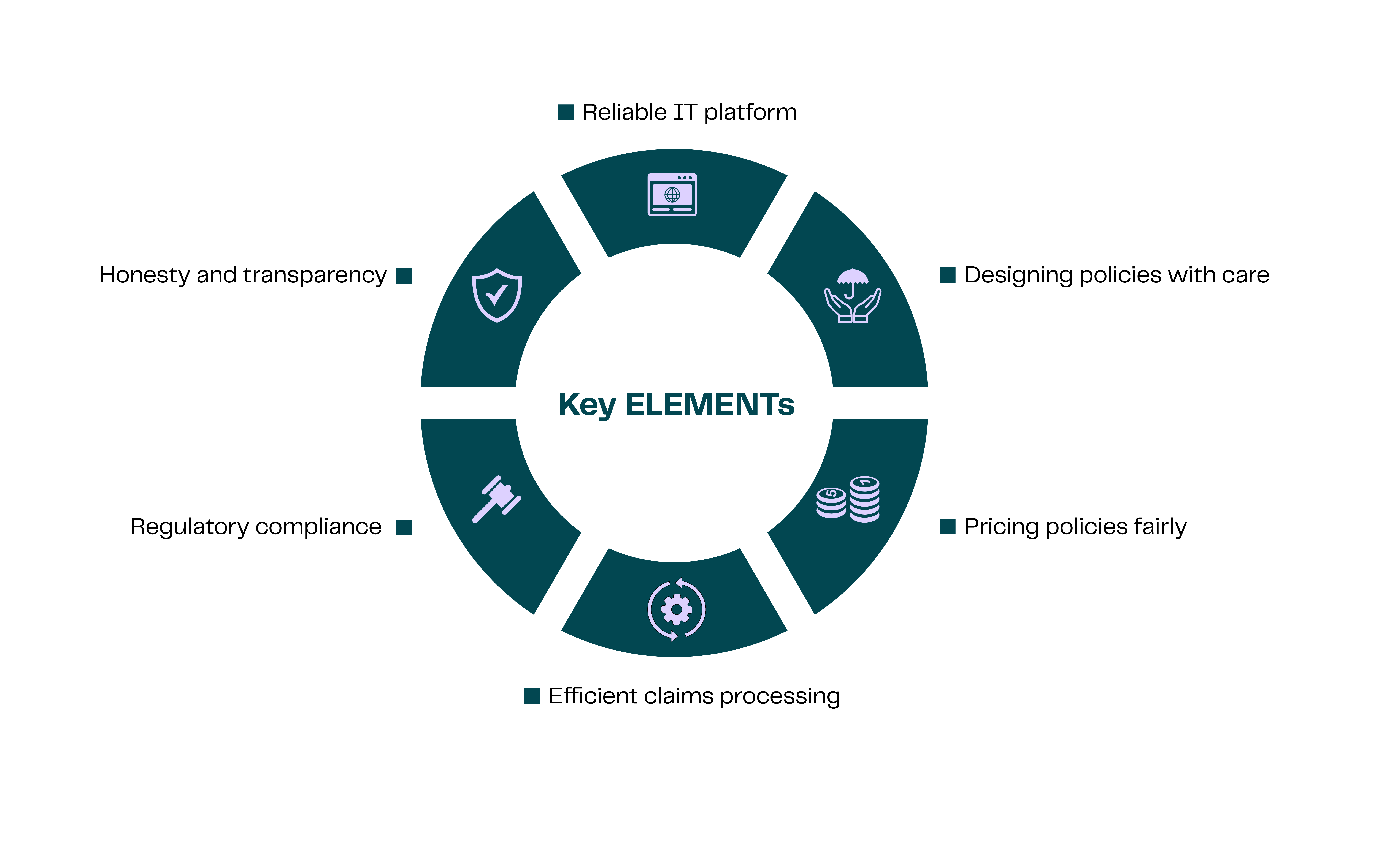

How to Achieve Reliability in Insurance

Achieving reliability in insurance requires a concerted effort by all actors involved in the insurance value chain: insurers, intermediaries, policyholders, and regulators.

Designing Policies with Care

The design of an insurance policy is crucial to its reliability. Policies should be carefully crafted considering the needs of the policyholder, the risks involved, and the likelihood of a claim in mind. The policy should be written in plain language, with all terms and conditions clearly explained. When was the last time you saw a Terms and Conditions document? Reading it can be quite challenging!

From a B2B2X perspective, designing policies with care is even more critical. Insurance policies in a B2B2X context involve multiple stakeholders, including the intermediary and the end customers, who all have unique needs and expectations. To ensure that the policy is reliable, the insurance carrier must carefully assess the risks involved and design the policy accordingly. This may involve customizing the policy to meet the specific needs of each intermediary or end customer. It is also essential to use clear and concise language when drafting the policy to avoid misunderstandings and misinterpretations.

As an insurance carrier, ELEMENT works closely with its partners to ensure that the policies are tailored to meet the needs of their customers. From conducting a thorough analysis of the risks involved to working very closely with its partners to develop policies that provide comprehensive coverage while remaining affordable and easy to understand. By designing policies with care, ELEMENT enables its partners to provide reliable insurance services to end customers.

Pricing Policies Fairly

Pricing is also crucial to the reliability of an insurance policy from both insurance companies' and policyholders' perspectives. Policies should be priced fairly, taking into account the risks involved, the likelihood of a claim, and the cost of providing coverage. Unfairly priced policies may lead to a lack of trust and a loss of policyholders.

At ELEMENT, we work closely with our partners to provide and agree on the most optimal pricing for end customers.

Honesty and Transparency

Insurance companies should be honest and transparent in their dealings with policyholders. This means providing clear and accurate information about policies, claims, and premiums. Policyholders should be promptly informed of any changes to their policy or coverage. Additionally, policyholders should be able to reach the insurance company fast enough in case of claims.

At ELEMENT, we provide a Customer Portal for the end customers of our partners, offering them access to their policy documents digitally, viewing payment information and making queries regarding their policies when needed.

In addition to our customer portal, ELEMENT also offers a partner portal, which allows our partners to access their insurance policies, claims, and underwriting decisions quickly. Our partner portal is designed to be user-friendly and intuitive, providing our partners with a seamless experience. The platform is based on microservices, which allows us to scale quickly and efficiently while maintaining the reliability and stability of our systems.

Efficient Claims Processing

Efficiency in processing claims is essential to ensure the insurance policy is as reliable as possible for policyholders. Claims should be processed promptly and accurately, with policyholders receiving the financial support they need when they need it most. Insurance companies should have a streamlined claims process in place, with clear communication and timely updates provided to policyholders.

Our White-Label Customer Portal plays an essential role in ensuring that end customers of our partners can report their claims and see the progress of the claims processing.

Reliability of IT platforms

The use of IT platforms/systems in the insurance industry has significantly increased over the past few decades. Insurance companies now rely on technology to manage their operations, including automatic underwriting, claims processing, customer service, and risk management. Nowadays, IT systems are used to evaluate and price risks, handle claims, and manage policy changes. The reliability of these systems is critical to ensure that insurers can deliver efficient and accurate services to their customers.

To maintain the reliability of IT systems, the ELEMENT Product Development department invests in ELEMENT�s platform infrastructure and implements the best practices in IT management. This includes regular platform maintenance, monitoring, security testing, and backups to prevent system failures and data loss. By investing in our platform reliability, we want to ensure that ELEMENT can deliver consistent and accurate services to our partners.

Regulatory Compliance

Insurance companies must comply with strict regulatory requirements to ensure their reliability and are subject to the General Data Protection Regulation (GDPR), which governs the processing of personal data. It means that the processing of personal data must have a legal basis under the GDPR, including the right to be informed, the right to access personal data, the right to rectify or erase personal data, the right to restrict processing, and the right to data portability.

We at ELEMENT make sure that our platform provides a high level of security and confidentiality of personal data, including measures to protect against unauthorized access, data breaches, and other data security risks.

In conclusion, reliability is crucial in the insurance industry to ensure the well-being of policyholders and the industry as a whole. Achieving reliability requires careful policy design, fair pricing, honesty and transparency, and efficient claims processing. At the same time, technical reliability, including the reliability of IT systems, is also essential for insurers to deliver efficient and accurate services to their end customers. At ELEMENT, we invest in technical infrastructure and implement best practices in IT management to maintain technical reliability.

However, technical reliability is only one of the building pillars of overall reliability in insurance. Insurers must also comply with industry regulations to meet their obligations to policyholders. By investing in reliability both in tech and in the insurance product, insurers can maintain customer trust and deliver high-quality services to their partners and ultimately, to policyholders.