Customer Centricity and User Experience: The Future of Insurance

As technology evolves, buying products and services has become a bigger part of our lives. It cannot be denied that extraordinary factors, such as global pandemics, have changed our expectations in terms of interaction and experience when purchasing a product or service. We desire speed, seamless flow, personalized recommendations, and an increased sense of security and privacy.

Ponder on your most recent online purchasing experience, why did you favour a platform, website, or provider over another? Was it simply because of the availability of the product? Or was it because it provided a fast, seamless, hustle-free experience? I can say to a degree of certainty that it was probably because of the latter reason. This is a good indicator that User Experience is now an integral part of our everyday decisions.

Among all these changes, where does insurance stand? We are introduced to risks every single day, which may range from cyber risks, climate risks or sudden pandemics. This increased sense of being subject to risks and the fear of the unknown has made insurance of import in our lives. The increasing popularity of insurance has brought the user experience under the spotlight, with a quick online search showing various articles that criticize traditional insurers. In a majority of these articles, UX has been pinpointed as a recurring problem. The current customer base expects a unique experience from insurance providers and as such, insurers are compelled to update their ways of doing business.

This is an ongoing challenge and the question remains, where is the user experience in insurance headed?

Over the past years, we have seen a rise in various trends such as personalization, omnichannel distribution, embedded insurance, accessibility, artificial intelligence and many others. One topic that has become a trending topic for not just the insurance sector, but in the UX world at large, is a customer-centric UX approach.

What does a customer-centric approach or design mean?

Customer Centricity, sometimes called Customer-Centric Design, refers to putting the customers at the heart of the business and thinking about their current and future benefits. Here, businesses are accepting that what they envision for a product might be entirely different from what customers would like to see. Being customer-centric necessitates knowing what your customer wants now and being able to accurately predict their future needs, whiles acting proactively to reach out to them.

The goal here is to build lasting relationships and increase loyalty. It involves understanding customers' wishes, utilizing tools to personalize, simplify and speed up processes and including human interaction to provide the best support when required. Insurers are expected to ensure customers feel safe in the idea that the insurer ‘has their back’, especially in times of trouble i.e. when they need to go through Claims processes. There is no better way of providing a sense of security and warmth, than including humane interactions. We can easily say that being customer-centric means putting ‘human’ at the core of the business.

How do we, as ELEMENT, contribute to the future of UX in insurance?

Even though ELEMENT operates a B2B2X model, this does not keep us away from Users or Customer Experience as we have 3 different groups of customers or users. We have grouped them into Internal Customers, Partners, and end customers, and UX plays an integral part in every step we take in designing our processes. We are poised to deliver our goal of ‘using the endless possibilities of digitalization and creating the future of insurance’. One of our strengths is that we have always kept the different users/customer groups in mind and focused on designing processes that continuously improve their experience.

We shy away from a one-size-fits-all approach and instead employ a modular approach system where we can adjust our White Label Purchase Flow and services in accordance with the needs of our internal users, partners, and customers.

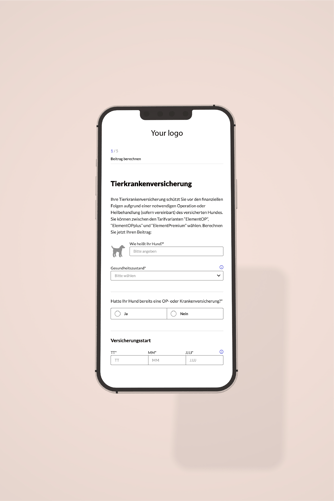

Our focus on Customer-Centric Design has facilitated us to build our White Label Purchase Flow, which provides a lean and seamless purchasing experience as one of its core values. It empowers our partners to inclose embedded insurance in their value chains. It supplies all the necessary information to the customer through a simple, effective design which is customizable to the partner’s brand identity. Aside from this, we have further developed other purchasing options for customers who prefer not to buy policies online. These insights which we acquired from partners’ feedback allow our partners to handle the insurance purchasing process for their customers without their being involved in the “boring” part and only enjoying the benefits of being insured.

We have also concentrated on creating fast and seamless 360-degree policy management and claim processes and have furnished our Partners and Customers with 2 different self-service points, which are the Partner Portal, and the Customer Portal. These two self-service points empower the customer or the partner representative to manage policies, create, and manage claims in a fast and simple way. This hassle-free experience we render through our touchpoints is one of our key strengths. We are incessantly developing our user interfaces and poised to automate most processes which require manual work to improve the experience of our internal users. Through our Back-office, we empower our internal users to set up new partners and products, configure pricing and execute Midterm Adjustments to policies in a fast and convenient way.

As we are aware that UX and customer-centric design is an ever-evolving and never-ending process, we are continuously improving our products through data analysis to improve the experience of our end customers, partners, and internal users. We aim to be more connected to our various users by using User Research to come up with new and innovative ways to improve their experience through our various touchpoints.

At ELEMENT, we are customer-centric and pay attention to our users as this is the only way to improve our offer and the experience of all our partners, customers, and our teams. We are readily equipped to provide stellar quality service to all user groups who are interacting with us through our policies and touchpoints.