Mastering Partnerships: Inside ELEMENT's Strategic Approach to Partner Onboarding Management

In the complex world of insurance, flexibility is not only a virtue but a necessity for insurers. Therefore, Partner Onboarding Management (POM) plays an essential role in ensuring that they remain agile and responsive to the ever-changing demands of the market. In a recent interview with Daniel Schwaiger, Senior Partner Onboarding Manager at ELEMENT, we discussed the important role of POM in navigating the complexities of partnerships and building sustainable relationships with our partners within the insurance ecosystem.

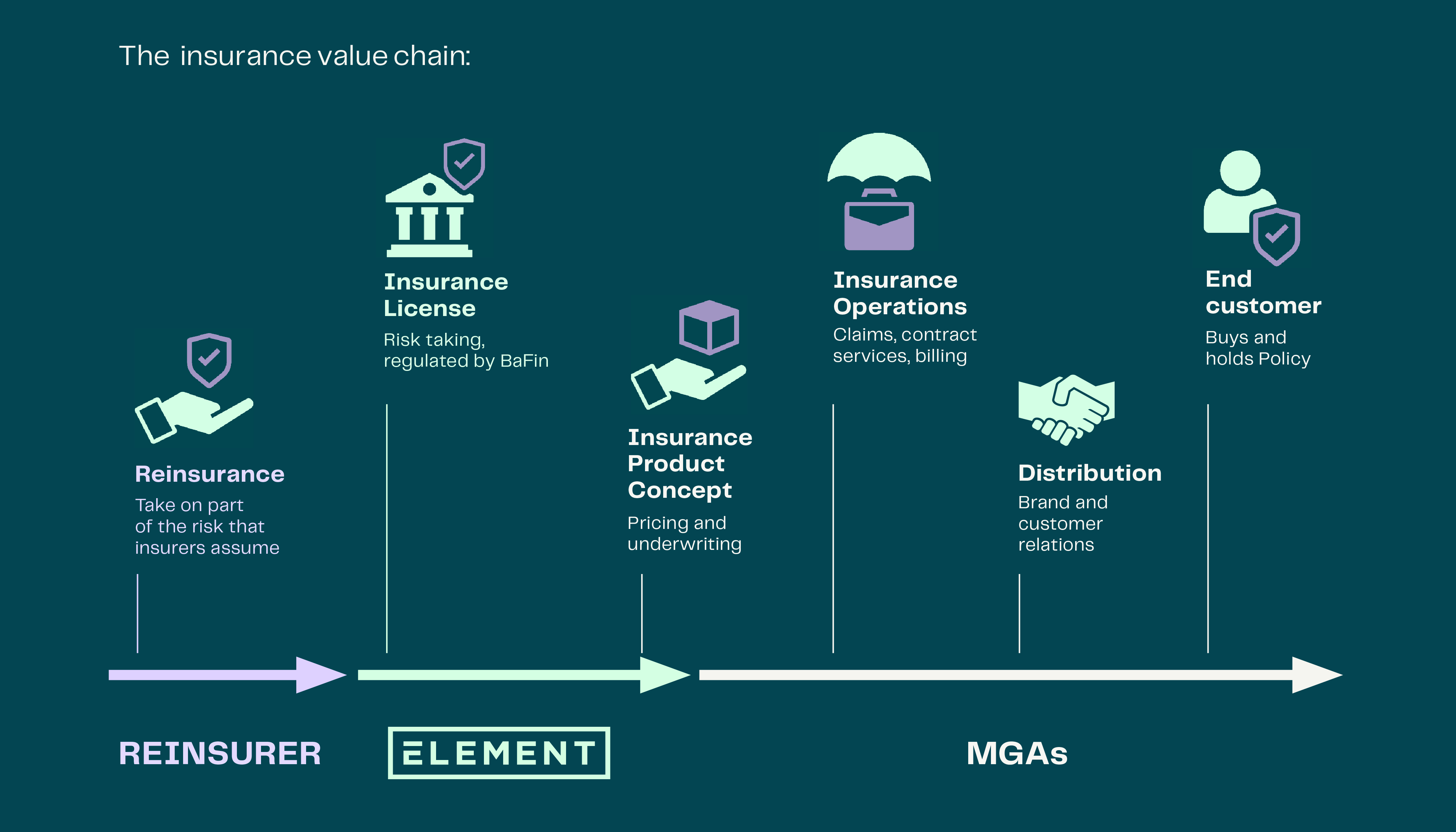

In our ongoing journey to reshape the contours of the risk ecosystem, ELEMENT is intensifying its integration efforts with MGAs. This strategic focus is driven by our commitment to combining the traditional role of a primary insurer with a lean and transparent approach to the management of risks, evolving into a genuine strategic ally in the success stories of our partners. MGAs also profit from ELEMENT’s extensive product and underwriting experience, further improving the bespoken product solutions in a compliant way.

The pivotal role of Partner Onboarding Management (POM)

Our offerings are tailored to the unique capabilities and requirements of our partners. Launching a partnership requires careful coordination, and at ELEMENT, the Partner Onboarding Management (POM) team plays a central and indispensable role in overseeing the entire project lifecycle. It has a multifaceted role in coordinating, finding solutions, and steering the project internally, while aligning with our partner(s) externally.

Providing market insights from our own experience in the market, we grant our partners with a positive track record in a specific product, with underwriting and claims handling authority – hence offering the fastest, most flexible, always reliable, and efficient insurance solutions.

Phases of a project

Our partnership journey unfolds in stages, each of which is crucial to integrating our product seamlessly into the partner's operations. Here is a breakdown:

1. Scoping Phase

In this initial phase, we work closely with our partner to align on key aspects and goals of the partnership. Our primary aim is to streamline the value chain while ensuring full compliance with regulatory standards. We provide comprehensive guidance to MGAs on operational and claims handling procedures to meet these requirements effectively.This will determine how data exchange and processes will be orchestrated. Our flexibility shines here, as we can accommodate various setups and ensure a digital exchange of data while minimising manual processes.

2. Execution Phase

After scoping, we move into the execution phase, which is dedicated to implementation. Here, we create the concrete insurance product by finalising the terms and conditions, reviewing outsourced activities such as service and claims processes, drafting, negotiating, and signing partnership contracts, and setting up the data exchange.

Once everything is implemented, we thoroughly test the entire customer journey end-to-end.

After the project goes live, it is assigned to a dedicated Account Manager who serves as a consultant and primary contact for our partners. The Account Manager assists with commercial and product management, resolves any issues that arise, and coordinates operational requests from the partner during the live phase.

Managing expectations

To ensure successful partnerships, it is essential to have a robust strategy for managing partner expectations. Our approach is based on agility, which is crucial when handling multiple partners and implementations simultaneously. Effective prioritisation and streamlined internal processes are imperative. Our experience with over 100 live product-partner combinations confirms our commitment to standardisation for expedited go-lives.

Our collaborative journey is designed for a rapid go-live and subsequent iterations. The iterative process is a powerful tool for perfecting collaboration and maintaining adaptability to market changes and partner expectations.

Onboarding international partners

Expanding strategically further into more EU countries has prompted the development of internal best practices for onboarding international partners seamlessly. Our focus is on establishing an efficient setup, ensuring compliance with Freedom of Service (FOS) requirements, and navigating the complexity of different regulatory frameworks. The main principle is to leverage the strengths of our partners, allowing them to manage tasks such as distribution, policy administration, and claims processing. These are the areas where their expertise and knowledge of their customer base shine.

Conclusion

Essentially, at ELEMENT, our approach to partnerships is dynamic, collaborative, and adaptable. We are not only navigating the complexities of the insurance landscape, but also actively shaping the future of partnerships within it.

This underscores our vision for a more interconnected and responsive MGA ecosystem. As we deepen our integration with MGAs, our pledge is clear – we are not merely an insurer; we are an enabler and connector: navigating the complexities of the insurance landscape together, fostering shared success and growth.